Medical And Dental Expenses Schedule A Instructions . medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses.

from www.smartsheet.com

you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). You can approximately deduct medical. medical expenses are deductible on schedule a of your tax return. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses.

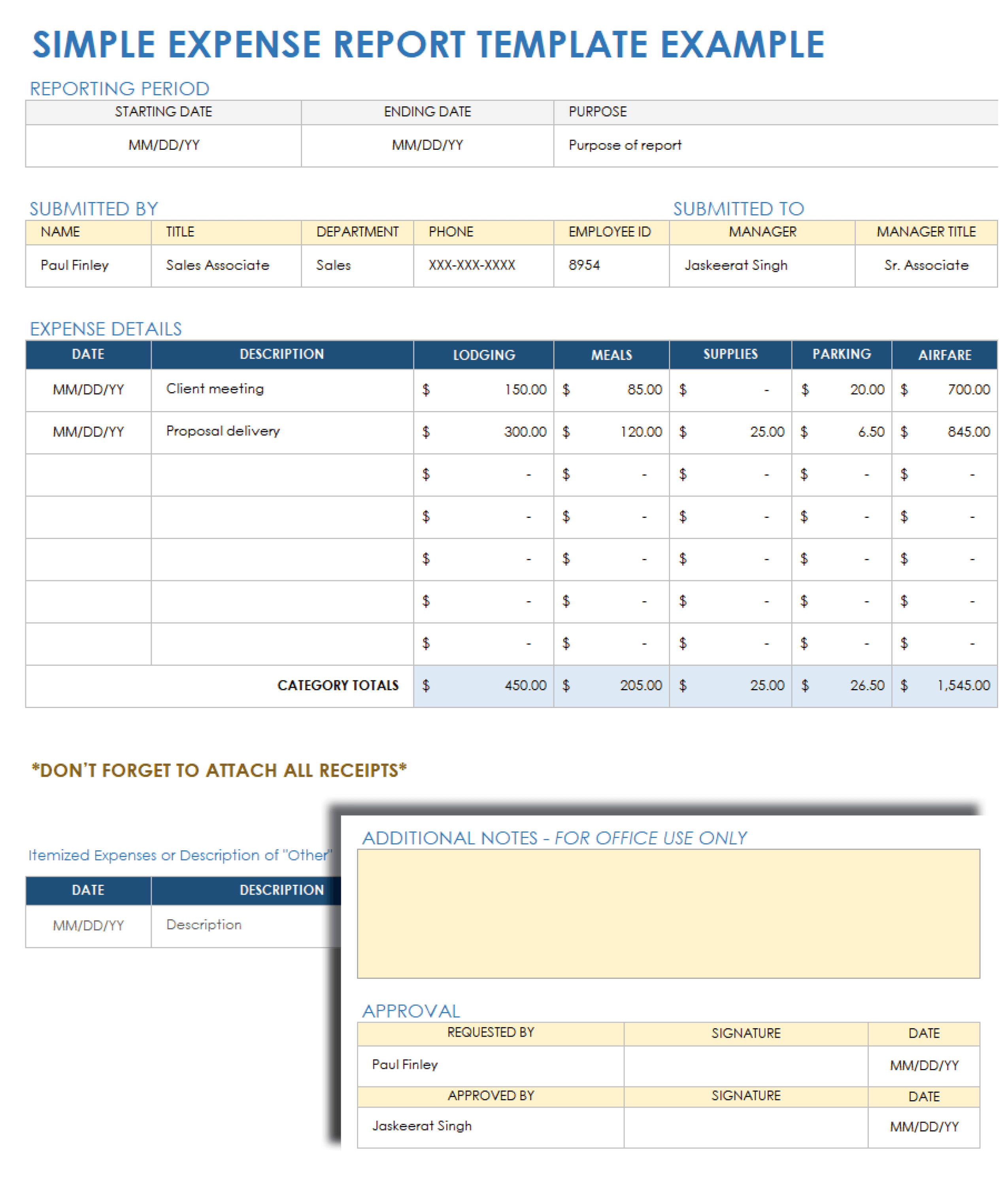

Free Google Docs Expense Report Templates Smartsheet

Medical And Dental Expenses Schedule A Instructions You can approximately deduct medical. You can approximately deduct medical. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a of your tax return.

From slidesdocs.com

Monthly Expenses Schedule Excel Template And Google Sheets File For Medical And Dental Expenses Schedule A Instructions if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses. medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is. Medical And Dental Expenses Schedule A Instructions.

From adaptive-dental-solutions.com

You can control your dental schedule Strategies for efficient Medical And Dental Expenses Schedule A Instructions medical expenses are deductible on schedule a of your tax return. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). You can approximately deduct medical. if you think the taxpayer may benefit from itemizing, enter the qualified expenses. Medical And Dental Expenses Schedule A Instructions.

From www.formsbirds.com

Itemized Deductions Form 1040 Schedule A Free Download Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a of your tax return. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized. Medical And Dental Expenses Schedule A Instructions.

From www.formsbank.com

Va Form 21p8416 Instructions For Medical Expense Report 2017 Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. if you think the taxpayer may benefit from itemizing, enter the qualified expenses. Medical And Dental Expenses Schedule A Instructions.

From es.scribd.com

Schedule A (Form 1040), Itemized Deductions Medical and Dental Medical And Dental Expenses Schedule A Instructions You can approximately deduct medical. medical expenses are deductible on schedule a of your tax return. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). Federal section>deductions>itemized deductions>medical and dental expenses. if you think the taxpayer may benefit. Medical And Dental Expenses Schedule A Instructions.

From www.examples.com

Fee Schedule 7+ Examples, Format, How to Set, Pdf Medical And Dental Expenses Schedule A Instructions Federal section>deductions>itemized deductions>medical and dental expenses. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). You can approximately deduct medical. medical expenses. Medical And Dental Expenses Schedule A Instructions.

From www.chegg.com

Solved How to complete the Medical and Dental Expenses Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. if you think the taxpayer may benefit from itemizing, enter the qualified expenses. Medical And Dental Expenses Schedule A Instructions.

From www.formsbank.com

Instructions For Schedule A And B (Form 1040) Instructions For Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a of your tax return. Federal section>deductions>itemized deductions>medical and dental expenses. You can approximately deduct medical. if you think the taxpayer may benefit. Medical And Dental Expenses Schedule A Instructions.

From www.dochub.com

Nurse tax deduction worksheet Fill out & sign online DocHub Medical And Dental Expenses Schedule A Instructions Federal section>deductions>itemized deductions>medical and dental expenses. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). You can approximately deduct medical. medical expenses. Medical And Dental Expenses Schedule A Instructions.

From www.formsbank.com

Instructions For Schedule A (Form 1040) Itemized Deductions 2011 Medical And Dental Expenses Schedule A Instructions if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. Federal section>deductions>itemized deductions>medical and dental expenses. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is. Medical And Dental Expenses Schedule A Instructions.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) Medical And Dental Expenses Schedule A Instructions medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you think the taxpayer may benefit from itemizing, enter the qualified expenses. Medical And Dental Expenses Schedule A Instructions.

From slidesdocs.com

Free Medical And Expense Schedule Templates For Google Sheets Medical And Dental Expenses Schedule A Instructions Federal section>deductions>itemized deductions>medical and dental expenses. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. You can approximately deduct medical. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses. Medical And Dental Expenses Schedule A Instructions.

From slidesdocs.com

Free Expense Schedule Templates For Google Sheets And Microsoft Medical And Dental Expenses Schedule A Instructions medical expenses are deductible on schedule a of your tax return. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. You can. Medical And Dental Expenses Schedule A Instructions.

From www.pinterest.com

Medical Expense Tracker Individuals can use this chart to track Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). Federal section>deductions>itemized deductions>medical and dental expenses. medical expenses are deductible on schedule a of your tax return. You can approximately deduct medical. if you think the taxpayer may benefit. Medical And Dental Expenses Schedule A Instructions.

From www.youtube.com

IRS Schedule A Medical & Dental Expenses YouTube Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses. You can approximately deduct medical. medical expenses. Medical And Dental Expenses Schedule A Instructions.

From www.youtube.com

Itemized Deductions Form 1040 Schedule A YouTube Medical And Dental Expenses Schedule A Instructions if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. Federal section>deductions>itemized deductions>medical and dental expenses. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are deductible on schedule a. Medical And Dental Expenses Schedule A Instructions.

From www.formsbirds.com

Itemized Deductions Form 1040 Schedule A Free Download Medical And Dental Expenses Schedule A Instructions you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). You can approximately deduct medical. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. medical expenses are deductible on schedule a of. Medical And Dental Expenses Schedule A Instructions.

From worldofprintables.com

FREE Printable Medical Expenses Tracker World of Printables Medical And Dental Expenses Schedule A Instructions Federal section>deductions>itemized deductions>medical and dental expenses. if you think the taxpayer may benefit from itemizing, enter the qualified expenses on schedule a. medical expenses are deductible on schedule a of your tax return. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your. Medical And Dental Expenses Schedule A Instructions.